Right now on Amazon, you can grab this 6-pack of Plastic Cutting Boards for the Kitchen at its lowest price ever

Living Well Without Going Broke

Right now on Amazon, you can grab this 6-pack of Plastic Cutting Boards for the Kitchen at its lowest price ever

Right now on Amazon, you can grab this LEGO Friends Skate Park Set at its lowest price ever

Right now on Amazon you can grab this Barbie Dreamtopia Unicorn Doll (Curvy, Blue & Purple Hair), with Skirt, Removable Unicorn Tail & Headband, Toy for Kids Ages 3 Years Old and Up at it’s lowest price ever

Right now on Amazon, you can grab this Rectangle Picnic Table Cloth, Waterproof Elastic Fitted Tablecloths for 6 Foot Table (Black, 30″x 72″) at its lowest price ever

Right now on Amazon, you can grab this Soundcore by Anker Space A40 Auto-Adjustable Active Noise Cancelling Wireless Earbuds at its lowest price ever

Right now at Kohl’s, you can grab this Sonoma Goods For Life® Home Sweet Home Coir Doormat for only $10.49!

Right now on Amazon, you can grab these Women’s Wide Legged High Waisted Dress Pants at it’s lowest price ever

Right now on Amazon, you can grab this Extra Soft and Absorbent Microfiber Luxury Bathroom Rug Mat 24×16 at its lowest price ever

Right now on Amazon, you can grab this 2 Pack Method All-Purpose Cleaner Spray, French Lavender at its lowest price ever

Right now on Amazon, you can grab this Select Iams Dry Dog Food at a ridiculous price

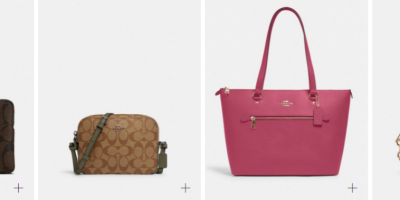

Coach Outlet: Up to 75% off + an EXTRA 20% Off Everything

Right now on Amazon you can grab this Tide Free & Gentle Laundry Detergent Liquid Soap, 64 loads, 92 fl oz, HE Compatible at it’s lowest price ever

Right now at the Kate Spade Outlet you can grab this Harper Crossbody for $63.20 shipped.

Right now on Amazon, you can grab this Dockers Men’s Straight Fit Signature Lux Cotton Stretch Khaki Pant at its lowest price ever

Right now at Woot, you can grab this 2-pack of Solar Wall Hanging Outdoor Lights for only $13.99.

Sealy Posturepedic Satin with Aloe Pillow Protector $4.79

Right now at Kohl’s, you can grab this Women’s Sonoma Goods For Life® Short-Sleeve Crew Tee for only $6.99!

Right now on Amazon, you can grab this 3 Count MRS. MEYER’S CLEAN DAY Hand Soap, Made with Essential Oils, Rain Water at its lowest price ever