Right now on Amazon, you can grab this RFID Travel/Passport Holder/Document Organizer/Credit Card Bag at its lowest price ever

Living Well Without Going Broke

Right now on Amazon, you can grab this RFID Travel/Passport Holder/Document Organizer/Credit Card Bag at its lowest price ever

Right now on Amazon you can grab this Happy Nuts Comfort Cream | Deodorant For Men | Anti-Chafing, Sweat Defense & Odor Control at it’s lowest price ever

Right now on Amazon, you can grab this 2-Count OFF! Deep Woods Insect Repellent Aerosol, Dry, Non-Greasy Formula at its lowest price ever

Right now on Amazon, you can grab this 5-Count GladWare Soup & Salad Food Storage Containers for Everyday Use at its lowest price ever

Right now at Kohl’s, you can grab these The Big One® Texture Stripe Bath Towel for only $2.99!

Right now on Amazon, you can grab this Bunch O Balloons 100 Grenade Rapid-Filling Self-Sealing Water Balloons at its lowest price ever

Right now on Amazon, you can grab these Men’s Tapered Track Athletic Slim Fit Sweatpants with Zipper Pockets at their lowest price ever

Right now on Amazon, you can grab this 2 Pack Spin Mop Replacement Head – Mop Refills Compatible with Ocedar EasyWring Triangle Spin Mop, Microfiber Mop Head for Easy Cleaning at its lowest price ever

Right now on Amazon you can grab this PLANTERS Variety Packs (Salted Cashews, Salted Peanuts & Honey Roasted Peanuts), 36 Packs at it’s lowest price ever- under $11.50.

Right now on Amazon, you can grab this LaCroix Sparkling Water, Key Lime, 12 Fl Oz (Pack of 12) at its lowest price ever

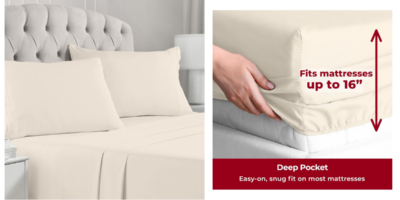

Right now on Amazon, you can grab this Mellanni King Size Sheet Set at its lowest price ever

Right now on Amazon, you can grab this Sun Bucket Hat, UPF 50, at its lowest price ever

Right now on Amazon, you can grab this Large Orthopedic Dog Bed with Egg Crate Foam Support and Non-Slip Bottom at its lowest price ever

Right now on Amazon, you can grab this PLANTERS Honey Roasted Peanuts, Salted Nuts, Flavored with Sea Salt and Honey at its lowest price ever

Right now on Amazon, you can grab this Stanley AeroLight Transit Ultra-Light Stainless Steel Bottle, Vacuum Insulated Tumbler at its lowest price ever

Right now on Amazon you can grab this Beckham Hotel Collection Bed Pillows for Sleeping – Queen Size, Set of 2 – Cooling, Luxury Gel Pillow for Back, Stomach or Side Sleepers at one of it’s lowest price ever when you clip the green coupon in the center of the page. They should be right around $35.

Right now on Amazon, you can grab this Victrola 8-in-1 Bluetooth Record Player & Multimedia Center, Built-in Stereo Speakers – Turntable, Wireless Music Streaming, Real Wood at its lowest price ever

The sling bag crossbody comes with a zipper main pocket, 3 card slots, 1 inner pocket and 1 front zipper pocket!